Here’s my presentation,

Transparency as Incentive for Internet Security:

Organizational Layers for Reputation,

from

RIPE 61 in Rome.

This presentation summarizes the two previous RIPE Labs papers

about proposed new organizational layers

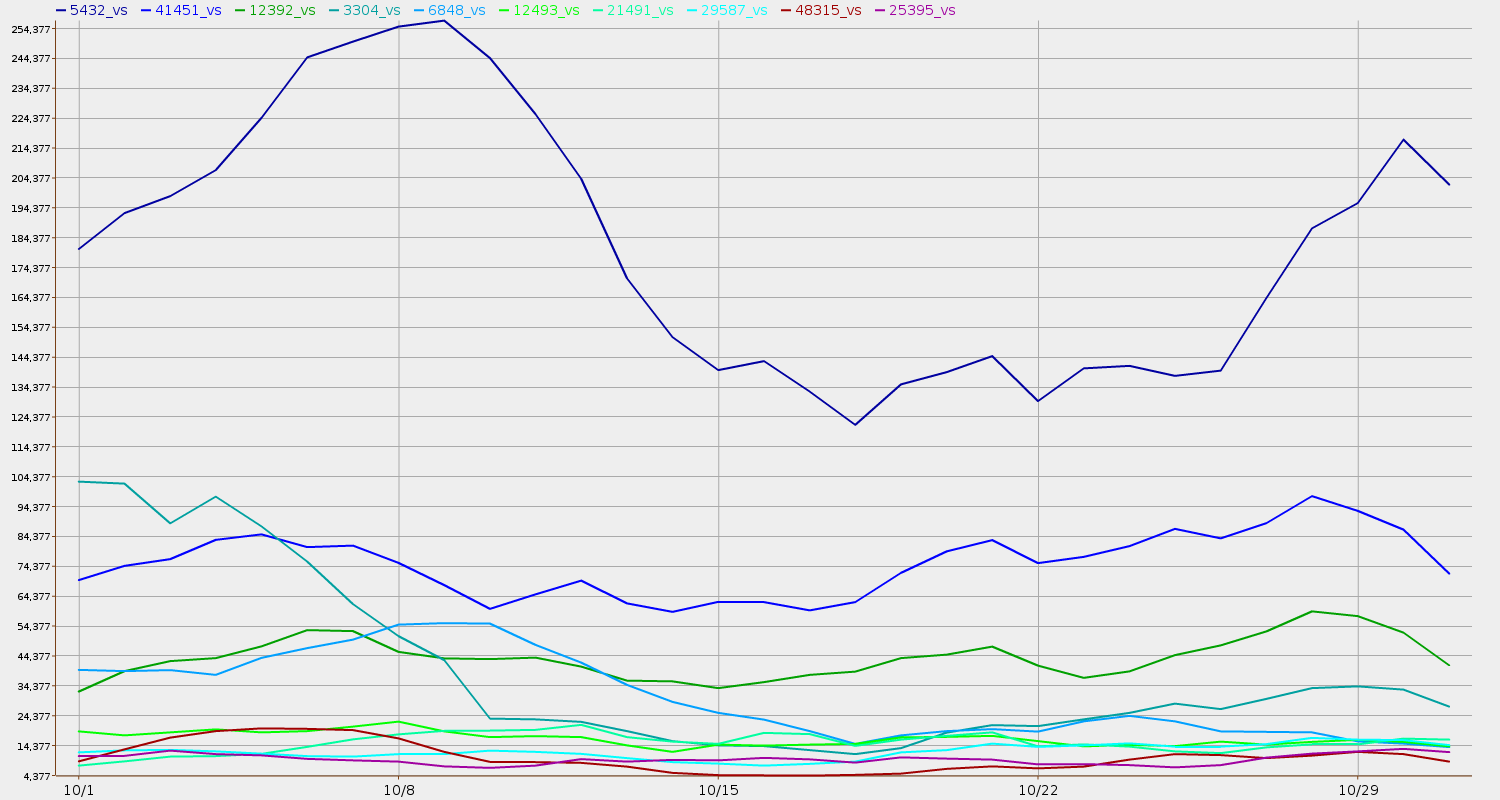

and outbound spam ranking experiments.

Here’s my presentation,

Transparency as Incentive for Internet Security:

Organizational Layers for Reputation,

from

RIPE 61 in Rome.

This presentation summarizes the two previous RIPE Labs papers

about proposed new organizational layers

and outbound spam ranking experiments.

RIPE-NCC is the oldest of the Regional Internet Registries (RIRs), and RIPE is the deliberately unorganized association of interested parties that meets twice a year and holds discussions online in between. It’s a mix of operations, research, and socializing. Topics range from obscure details of deploying IPv6 to organizational proposals such as what I was talking about. 430 people attended the meeting in Rome, which was quite a few more than the dozen or two of the first RIPE meeting I went to many years ago.

Interesting questions were asked. I may blog some of them.

-jsq